Unlock Global Opportunities: Let Us Help You Grow

E-Book - Table Banking

Sh10,665

Price per unit: Sh10,665

E-Book - Table Banking

Product Details

Take Control of Your Micro-Finances via Groups

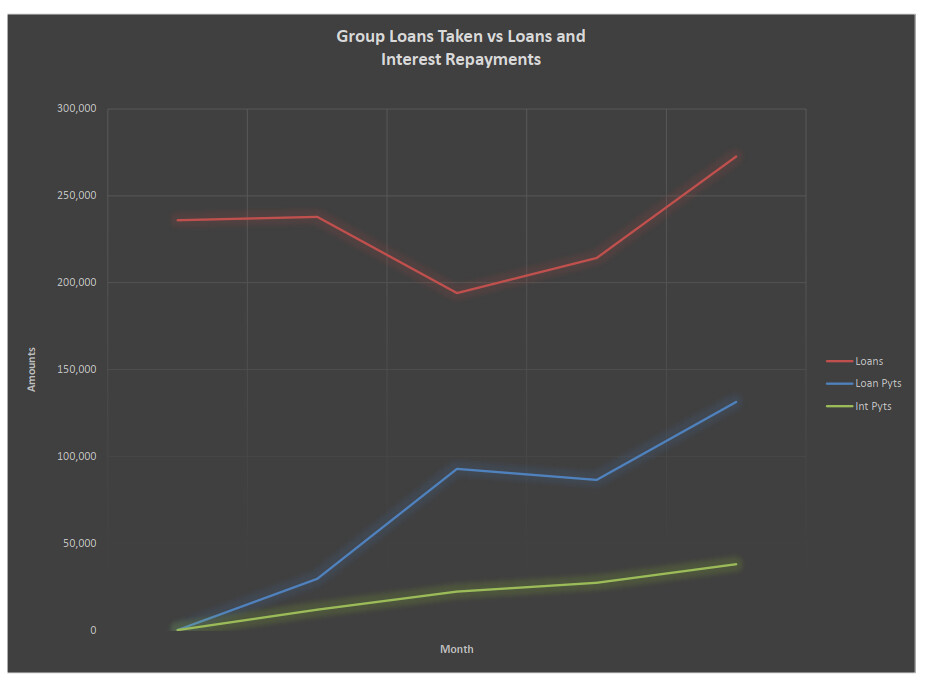

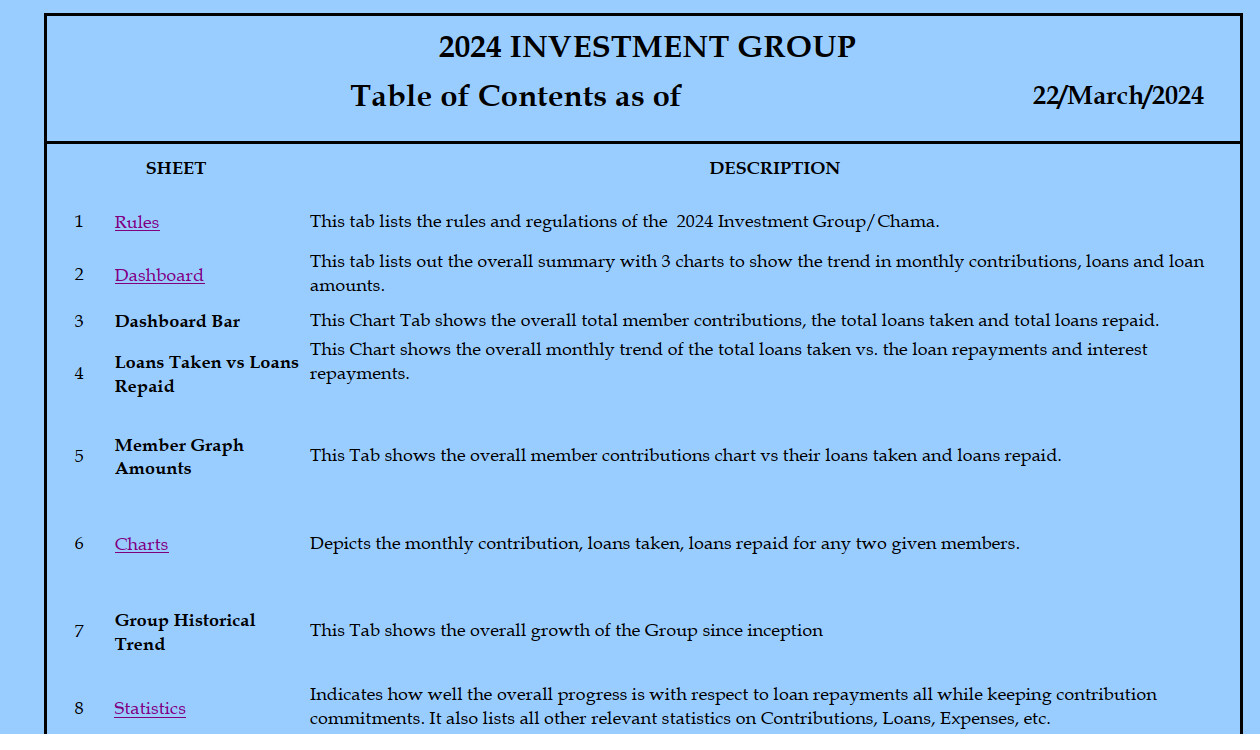

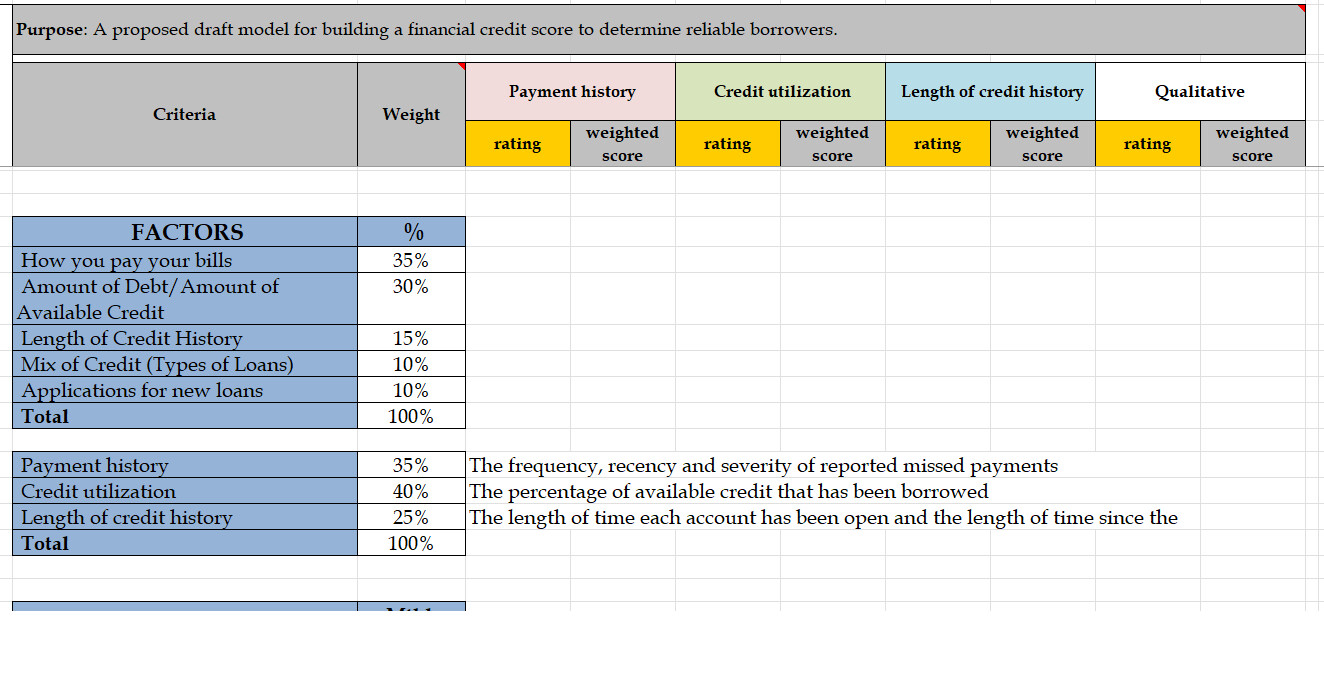

We provide a comprehensive guide and sample use with a Credit Score model and metrics for Table Banking.

Table banking is a type of microfinance model that involves a group of individuals coming together to provide loans to each other, without requiring collateral or a formal credit history. The group typically meets at a regular interval (e.g. weekly, bi-weekly or monthly) at a designated location, such as a member's home, where they pool their savings and make loans to one another.

The group elects officers, such as a treasurer, secretary and chairman, to oversee the group's activities and keep track of the group's funds. Members can take turns borrowing from the group's pool of funds, and are required to pay back the loan with interest. The interest payments are then used to replenish the group's funds and provide a source of income for the group.

Table banking is often used in developing countries where access to traditional banking services is limited or non-existent. It provides a way for individuals to access credit and build their credit history, while also promoting a sense of community and mutual support. Additionally, table banking can provide a safe and secure way for individuals to save their money, as it reduces the risk of theft or loss.

Overall, table banking is a community-based, self-help financial model that empowers individuals to take control of their financial lives and improve their economic well-being.

Get started today and experience the power and ease of table banking principles!

You May Also Like

Display prices in:KES